What Caused The Great Inflation Of The 1970s?

By | January 25, 2019

In the early 1970s, the stock market slumped, unemployment rose and the United States found itself suffering from an inflation crisis -- also known as the "Great Inflation" -- that lasted a decade. The causes of the Great Inflation of the 1970s have been analyzed and debated ever since. And certainly, at the time, there was no shortage of finger pointing: the rich were too greedy, the unions wanted too much money, the Arab oil-producing nations screwed the U.S., Nixon blew it, the Federal Reserve Bank blew it, the economic policy was all wrong.

That last theory is a popular one -- Wharton professor Jeremy Siegel summed it up as "the greatest failure of American macroeconomic policy in the postwar period."

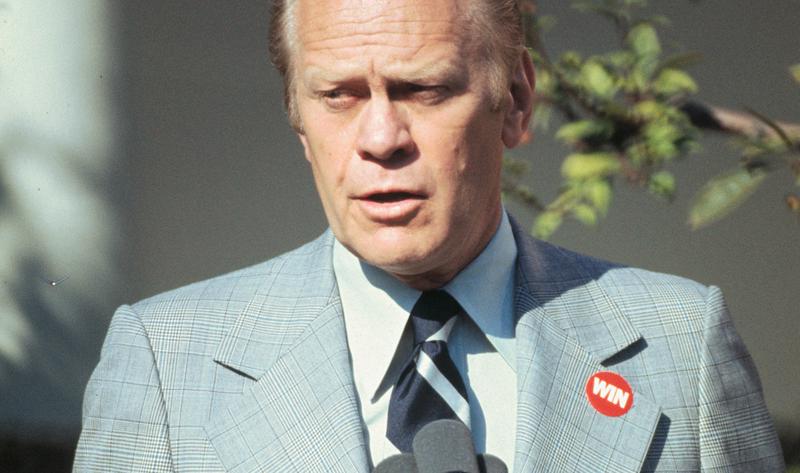

There was no quick fix to the Great Inflation, much to the chagrin of President Gerald Ford. Ford tried to will America out of inflation with pep talks and a stillborn PR campaign called "WIN -- Whip Inflation Now."

There was also no tidy explanation of the causes of the Great Inflation of the 1970s. It happeded due to a variety of factors that played into a sustained inflation in the United States that affected the rest of the world as well. The key thing to remember is that none of the players involved were actively trying to send America into a recession with out of control inflation.

Nixon Pressured The Fed To Lower Interest Rates

While this isn’t the only reason for the rising inflation rates of the ‘70s it’s definitely something that should be considered. In the lead up to the 1972 election President Nixon wanted to assure the American people that they were safe with him. In order to keep the economy on track he fired Fed Chairman William McChesney Martin and put presidential counselor Arthur Burns in his place in 1971. Doing this allowed Nixon to maintain low-interest rates from the Fed.

Low-interest rates make it easier and cheaper to borrow money, thus growth is more easily stimulated and the economy is strengthened. At the time, Nixon allegedly told Burns, “We'll take inflation if necessary, but we can't take unemployment.”

Nixon’s plan briefly worked. The economy was stimulated and he swept the '72 election. But a few short months after the election, the inflation rates rose to 8.8%; they’d later rise to 12 and then 14% before the recession ended.

The False Nature Of The Phillips Curve

Before getting into why the Phillips Curve isn’t necessarily correct we have to understand what it is. The Phillips Curve, named for William Phillips, is an economic model that shows the relationship between unemployment rates and the rise of inflation. As simple as that sounds, the curve can become extremely convoluted when other aspects are at play.

In the 1960s and '70s, many economists believed that you could stabilize the economy by lowering unemployment rates, which would be accomplished by slightly raising inflation rates from year to year. Essentially, they thought that by raising inflation by a percentage point from one year to another as a way to ease people into the higher prices of goods and services. Economist Edmund Phelps explained it as such:

[I]f the statical ‘optimum’ is chosen, it is reasonable to suppose that the participants in product and labour markets will learn to expect inflation…and that, as a consequence of their rational, anticipatory behaviour, the Phillips Curve will gradually shift upward...

Rather than gradually increasing inflation by small measures, policy makers pursued higher rates of inflation in the early '70s, which led to higher rates of unemployment, which meant that people couldn’t catch up to the inflation. This misunderstanding of the Phillips Curve is what sent much of the country spiraling into debt.

The Disintegration Of The Bretton Woods Agreement

Simply put, the Bretton Woods Agreement is what put the global economy on the gold standard in 1944. Under that agreement, the U.S. dollar was made the reserve currency and it was most closely associated with the price of gold. From the ‘40s through the ‘70s (and even until the current day, really) the global economy grew in leaps and bounds, which meant that the U.S. dollar was in high demand. Over time, foreign banks took on more U.S. dollars than the U.S. had in gold, which meant that the U.S. couldn’t maintain a one-to-one ratio for the two currencies. This kind of thing isn’t a huge problem until people start trading their cash in for gold in large droves, but that only happens when inflation rises.

Well, rise it did in the back half of the ‘60s, and people began trading in cash for gold in droves. In 1971, President Nixon stopped foreign markets from trading in U.S. currency, and shortly afterwards the global economy moved off the gold standard, untethering the dollar from anything fiscally tangible and moving us into purely speculative territory. This change in economic stability eroded U.S. and global faith in the dollar, and that skepticism played a major role in the recession and rising inflation rates of the 1970s.

A Surge In Oil Prices Made Inflation Even Worse

While the Arab oil embargo that began in 1973 wasn’t the sole cause of inflation, it did create a shortage that caused oil prices to quadruple. That means that while people were losing their jobs and the cost of goods were spiraling out of control, people weren’t able to pay for gas, so they couldn't drive their large American automobiles, so they couldn’t look for work. It wasn’t exactly The Walking Dead, but at the time it felt apocalyptic.

During the embargo, interest rates were in major flux, which made it impossible for companies to know whether to lower or raise prices on commodities. Rather than lower prices and take a fiscal hit, businesses just kept their prices high and didn’t hire anyone new, which only deepened the recession.

Policymakers Had Bad Data

It’s impossible to make a good decision without having the best data at hand. And when you’re trying to make a judgment about something that effects the entire country you need to have the most accurate information you can get. Unfortunately policy makers in the 1970s often didn’t have great intelligence about the cause and effects of inflation. Economist Athanasios Orphanides says that the numbers that lawmakers had were significantly off, specifically data relating to the rate of unemployment consistent with full employment.

This means that policymakers didn’t think that their decisions would have the adverse effects they did. This plays back into the misunderstanding of the Phillips Curve, in that many lawmakers believed that raising the rate of inflation would drive people to seek more gainful employment, thus lowering unemployment rates -- unfortunately that’s not how things worked out.